Finding the perfect match – A payroll solution that fits your business

“One-size fits all” doesn’t apply to any area of a small businesses. Small businesses come in all shapes and sizes, serving a variety of customers and spanning a myriad of industries. Accordingly, each business has its own diverse needs and preferences when it comes to handling business processes. You are always striving to make the best possible decisions for your business’ long-term success and growth, including some fundamental decisions for workflows and processes. This can often involve a lot of time to research, and consume tons of mental energy. To determine the “right” decision for your business, you may solicit advice and recommendations from a few trusted friends and peers, who have faced the same decisions in the past.

Well, count us in! At 5minuteBookkeeping, we love to share our recommendations for some of the fundamental choices a business needs to make, enabling you to focus your time and energy on the really big stuff. Among the essential decisions you need to make for your business is choosing a payroll solution. We want to share our own payroll journey with you, clarify the difference between types of payroll solutions, and provide a payroll decision making checklist to help you identify what’s most important to you and which payroll providers offer those things. Ultimately, we want to help you with finding a perfect match – a payroll solution that fits your business.

Our payroll evolution

At VM Wasek, we’ve gone through a bit of a payroll ‘evolution’ as our business grew. In the beginning, we handled our payroll with manual checks and self-filings. As we grew to include more staff, we signed on with a large full-service payroll provider. After a while, we decided to convert to QuickBooks Payroll service, to make sure it was something we could recommend to our clients. We used both Intuit Full Service Payroll, and then QuickBooks Full Service Payroll, with great success. Lately, we’ve been hearing wonderful things about a new(er) contender called Gusto. No, we don’t have commitment issues when it comes to payroll services, we just love trying out new interfaces and integrations in our endeavors to ‘minimize bookkeeping’. Show us something to save time and or money, while delivering a quality product/service, and we’ll pay attention!

That being said, we decided to take a look at Gusto to see how it compares to some other payroll service providers – to determine if we should make a switch ourselves, or at least know if we could recommend it to others. We absolutely like what we see, and want to share some information with you to help determine a perfect fit to grow with your business.

What are my options?

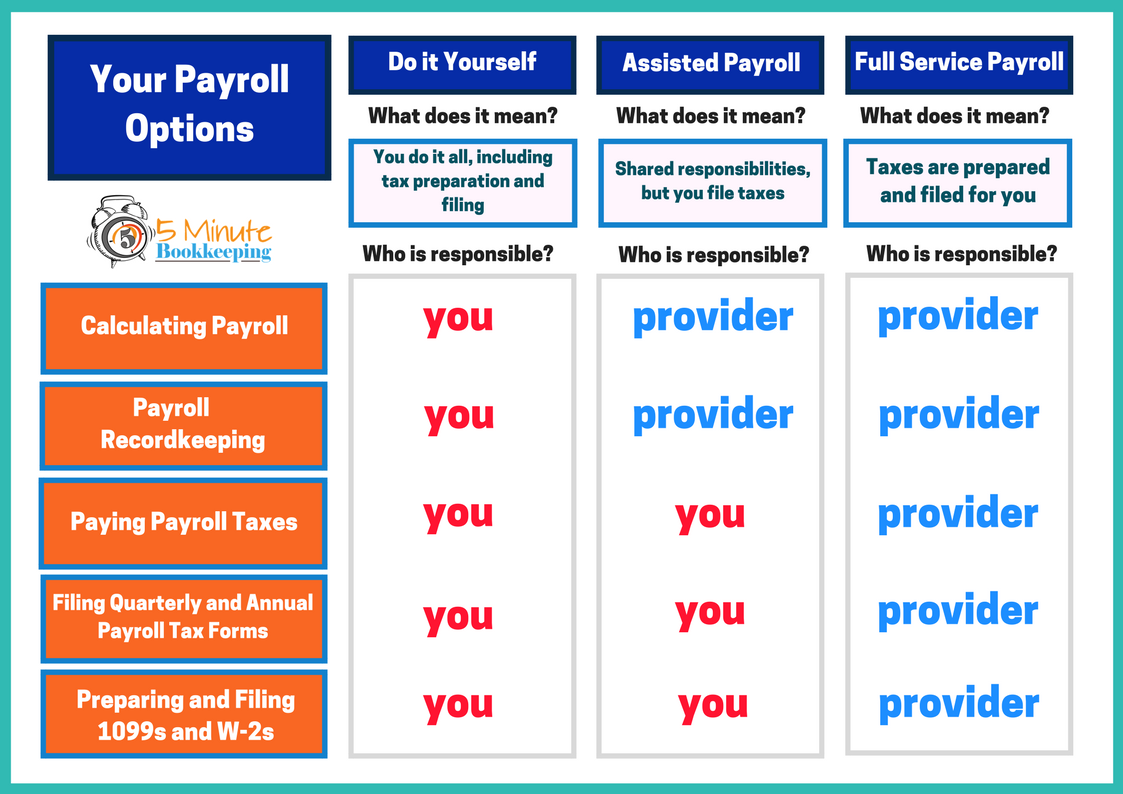

One of the first payroll solution decisions you’ll need to make is how much assistance you want – whether to go at it on your own, or to use an assisted payroll or a ‘full service’ solution. What’s the difference between ‘do-it-yourself’, assisted and full-service payroll solutions? Each involves different levels of time and effort from you and your team, and offers varying levels of assistance. Here is a comparison chart to help clarify who is responsible for what (between you and the provider: I.e. the payroll service) for different types of payroll solutions.

How much assistance do I want or need?

Do-it-Yourself Payroll

Most small businesses encounter different stages of growth, and may initially begin paying just a few employees or sub-contractors with hand-written or self-printed checks. This option includes the chore of calculating tax withholdings (if applicable), submitting corresponding payments to the IRS, and issuing year-end tax forms (W2s and 1099s). You may find that you are spending just a little too much time calculating and delivering individual checks, sending off tax payments, and filing forms. Your time and effort are valuable to your company! This is why, we don’t recommend the DYI approach for payroll.

Your time and effort are valuable to your company! This is why, we don’t recommend the DYI…

Click To Tweet

We definitely recommend getting some assistance with your payroll functions, so your next step is determining the help you want or need.

Assisted Payroll

An ‘assisted’ payroll option provides an interactive platform that calculates your tax withholdings and other deductions, and allows you to print your own paychecks. The payroll service will keep records for you, and provide you with reports. You are still responsible for filing those tax forms and payments yourself, including the year-end taxes, but the calculations and documentation are provided for you. You will be able to issue direct deposits through the payroll service, and print payroll checks.

Full Service Payroll

‘Full-service’ means the payroll service will calculate tax withholdings, file tax payments, and issue year-end tax forms. The service will allow you to issue direct deposits to employees, and print payroll checks as well.

How do I choose the right fit for me?

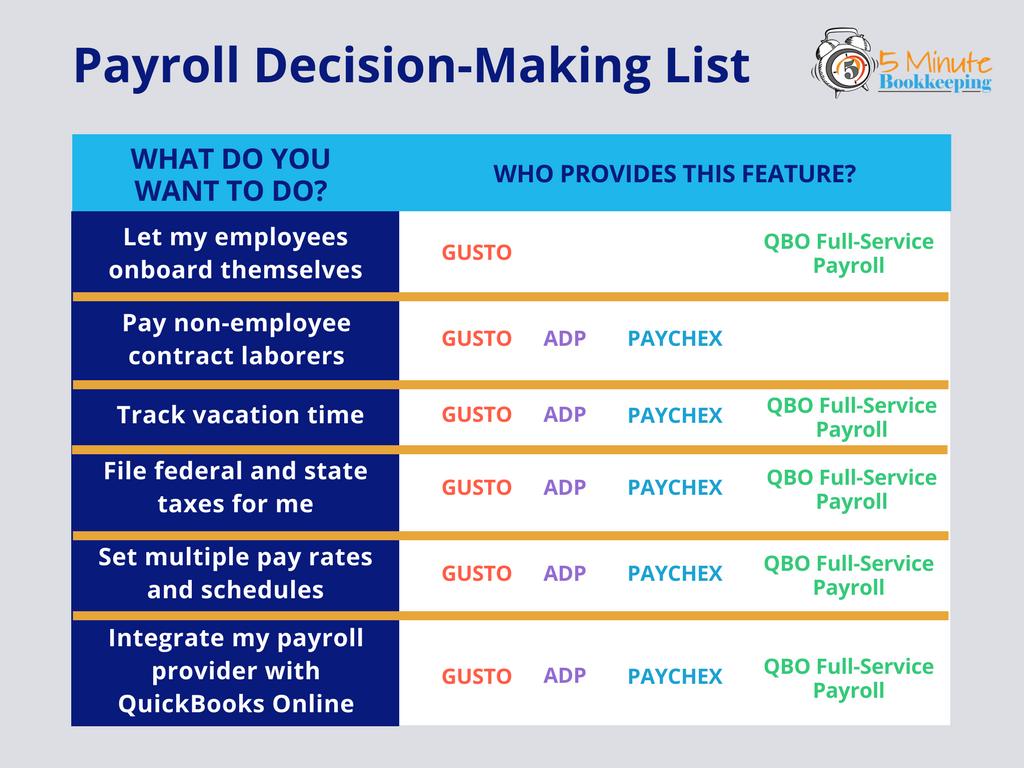

Various factors go into the determination of which payroll solution best fits your business needs. I recommend making a list of priorities, to ensure that you find a solution that matches your greatest needs. Once you determine what matters most to you, you can begin a side-by-side comparison of different payroll solutions, and then a cost comparison to see what fits into your budget.

Here’s a decision making checklist we put together to compare features across different providers:

Other considerations

Additional priorities may include how quickly direct deposits are received from the time you process payroll, how paper checks are handled, and, of course, pricing. The direct deposit lead time does vary with different service providers, from 24 hours to up to 4 days. Also, some providers will issue paper checks and mail them to your business to distribute, while others allow you to print your checks directly from QBO.

For details on exact options and pricing for each of the service providers we’ve mentioned, you can directly visit each website through the links listed below. Some will even provide you with a demo to get a peek at the interface, and some of the features.

| |

|

Why we are excited about Gusto

One of the reasons that our firm is excited about Gusto, is that gives a company our size quite a cost-savings compared to some of the other solutions we have used. Gusto’s current published rate is just $39 per month, and an additional $6 per month/employee. This may be more affordable for your small business as well.

Gusto also offers just one payroll option: full-service across the board. Yay! Yet another feature we are excited about is the “employee self-onboarding”, which enables each employee to enter many their own personal details – so you don’t have to (you’ve probably caught on by now that we are all about efficiency – saving time and money)!

Closing

I hope we’ve provided you with some useful tools for finding a perfect match – a payroll solution that fits your business. We highly recommend a full-service payroll solution to free up your time and energy, and believe that there are fantastic options out there, including Gusto. Ultimately, your payroll decision depends on your individual pain-points and priorities. We encourage you to explore the available options and free yourself up from back-office tasks as much as possible, so you can focus on what you do best – being awesome!!!

The post Finding the perfect match – A payroll solution that fits your business appeared first on 5 Minute Bookkeeping.

Comments

Post a Comment